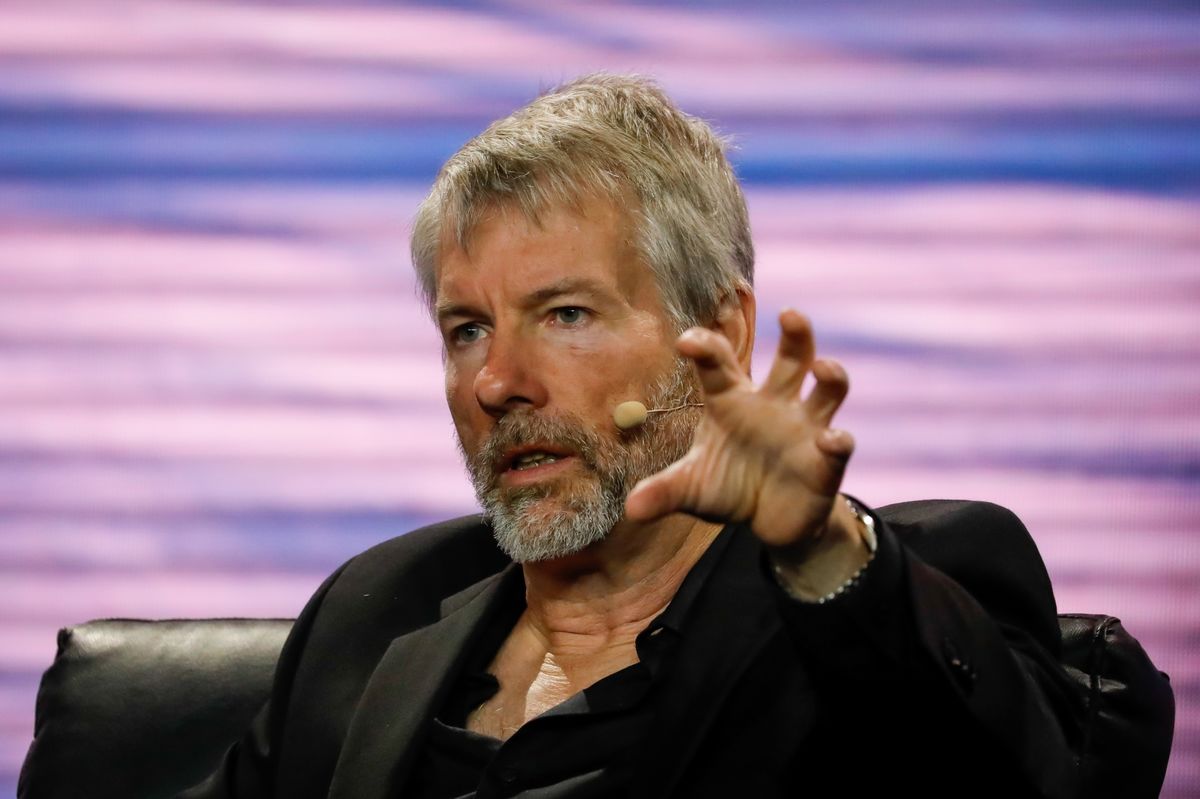

A statement the company released on Tuesday afternoon confirmed that the CEO of MicroStrategy, Michael Saylor, is leaving his role to become the company’s chairman.

Phong Le, the company’s president, will fill the CEO role.

Having been in the role of the chief executive officer since establishing the company in 1989, Michael Saylor is moving on to a new position – executive chairman. The entrepreneur, who’s one of the biggest supporters of Bitcoin, is making the switch at a time that MicroStrategy’s stock has plummeted by over 48%. Bitcoin is also down by over 51% around the same time. Although, the entrepreneur is doubling down on his stance that people should keep investing in Bitcoin.

“I believe that splitting the roles of Chairman and CEO will enable us to better pursue our two corporate strategies of acquiring and holding bitcoin and growing our enterprise analytics software business. As Executive Chairman, I will be able to focus more on our Bitcoin acquisition strategy and related Bitcoin advocacy initiatives, while Phong will be empowered as CEO to manage overall corporate operations,” Mr. Saylor said in the release.

The announcement comes in the wake of the company’s announcement of its second-quarter earnings. Its recorded total revenues dropped by 2.6% compared to a year ago. The value of the company’s digital assets, mainly Bitcoin, also got an impairment charge of $918 million, as reported by the company.

Saylor has stated that the publicly traded company remains the first and only Bitcoin spot exchange-traded fund in the United States, even though it’s in the business of cloud bases and enterprise software services. “We’re kind of like your nonexistent spot ETF,” Saylor told CNBC on the sidelines of the Bitcoin 2022 conference in Miami in April. “If there was a spot ETF, you’d be paying a 1% fee, and it wouldn’t be leveraged. With MicroStrategy, we have a software company that generates cash flow, so we convert our cash flows into bitcoin,” he added.

Over the last two years, MicroStrategy has been including Bitcoin in its corporate balance sheet. Over the years, the company has spent about $4 billion on buying Bitcoin at an average price of $30,700. More than once, Michael Saylor has publicly thrown his weight behind Bitcoin and it’s potential for growth while publicly sharing his level of involvement with investing in the cryptocurrency.

During his time as CEO, Saylor made many decisions that made the company buy Bitcoin using company debt. In March, he borrowed $205 million using his Bitcoin as collateral to buy more bitcoins. “We have $5 billion in collateral. We borrowed $200 million. So I’m not telling people to go out and take a highly leveraged loan. What I am doing, I think, is doing my best to lead the way and to normalize the Bitcoin-backed financing industry,” Saylor said in April. “As people realize they can borrow against something, then they realize they never have to sell it, and then they start to stretch their time horizon from — ‘It’s a 36-month speculation,’ to — ‘It’s a 36-year holding,” he added.